At Credit Capital Keys, our mission is to empower individuals with the knowledge, tools, and strategies to unlock financial freedom. We’re dedicated to helping clients understand, build, and leverage credit as the foundation for lasting success

WHO WE ARE

We Are Funding & Credit Repair Experts

Empowering Your Financial Future & Expert Funding Consultants & Credit Repair Solutions You Can Trust

Build Strong Credit. Unlock Funding. Grow Your Business.

Welcome to Credit Capital and Keys, your trusted partner in credit repair and business funding.With years of proven experience, our dedicated team is here to help you take control of your financial future by strengthening your credit profile. We know that managing credit challenges can feel overwhelming, which is why we provide transparent solutions, personalized guidance, and unwavering support every step of the way.Discover how Credit Capital and Keys can help you rebuild your credit with confidence and unlock new opportunities for funding and growth.

Credit Repair

Let’s fix your credit and open new doors together

Collection & Charge Off Removal eBook

Proven DIY strategies to remove collections and charge-offs

Want to access up to 250k in Funding?

What is credit repair?

Credit repair refers to the process of identifying and addressing issues on your credit report to improve your credit score. This typically involves disputing inaccurate or outdated information, negotiating with creditors, and improving financial habits.

Why is credit repair important ?

A higher credit score can help you secure better loan terms, lower interest rates, and improve your chances of being approved for credit cards, mortgages, or car loans.

How Long Does Credit Repair Take?

For your credit repair service, the duration can vary based on the individual's credit profile. Typically, it may take anywhere from 3 to 6 months, but in more complex cases, it could extend up to 1 year. This timeline depends on the number of negative items to be addressed, the responsiveness of creditors, and how consistently the client follows the process for disputing and rebuilding their credit.

Who is eligible for funding?

Be 18 years or older

Have a verifiable income or business revenue

Meet credit or financial criteria specific to the funding source

What types of funding do you offer?

Business loans and lines of credit

Personal loans

Credit-building solutions

Frequently Asked Questions

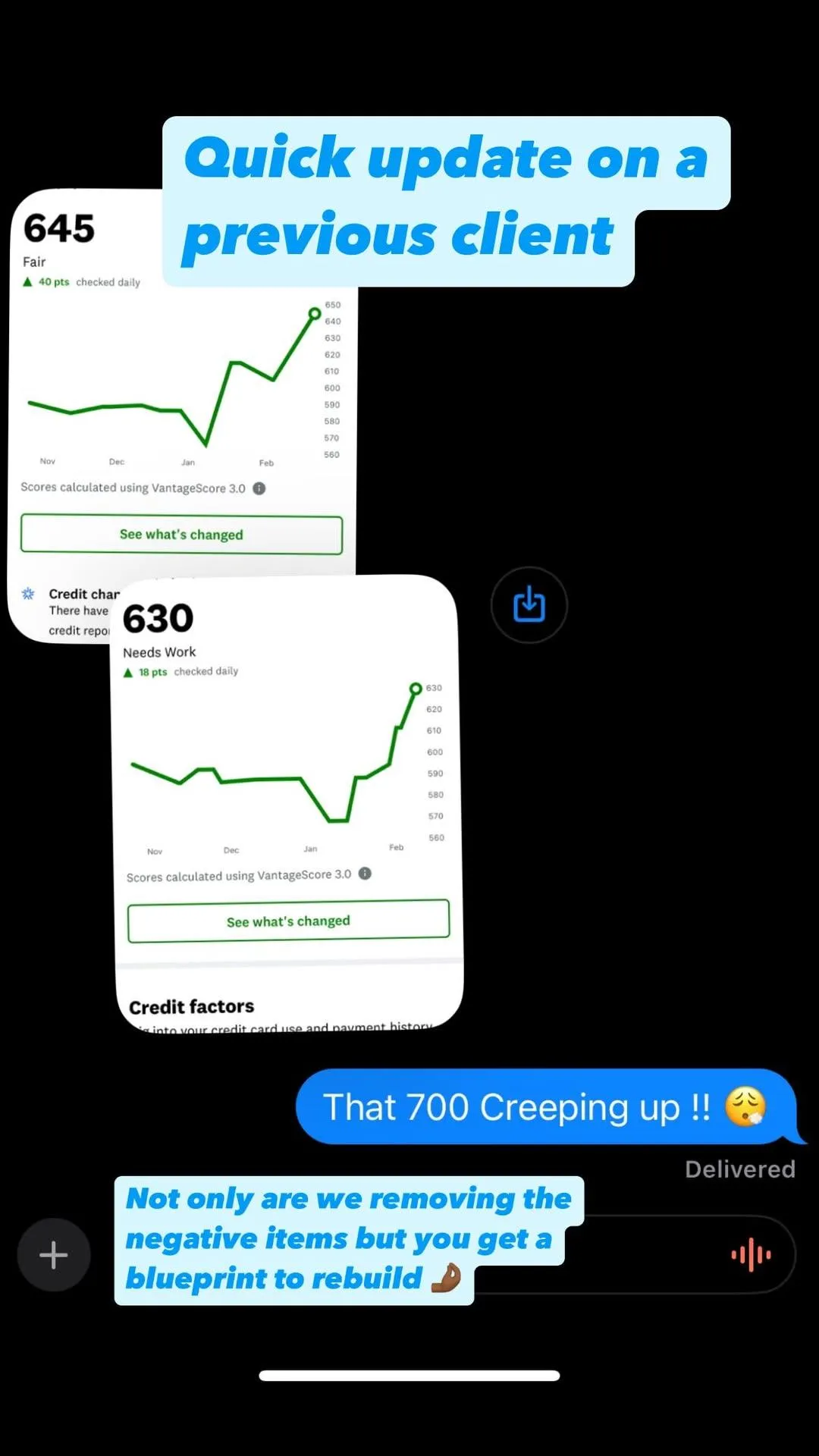

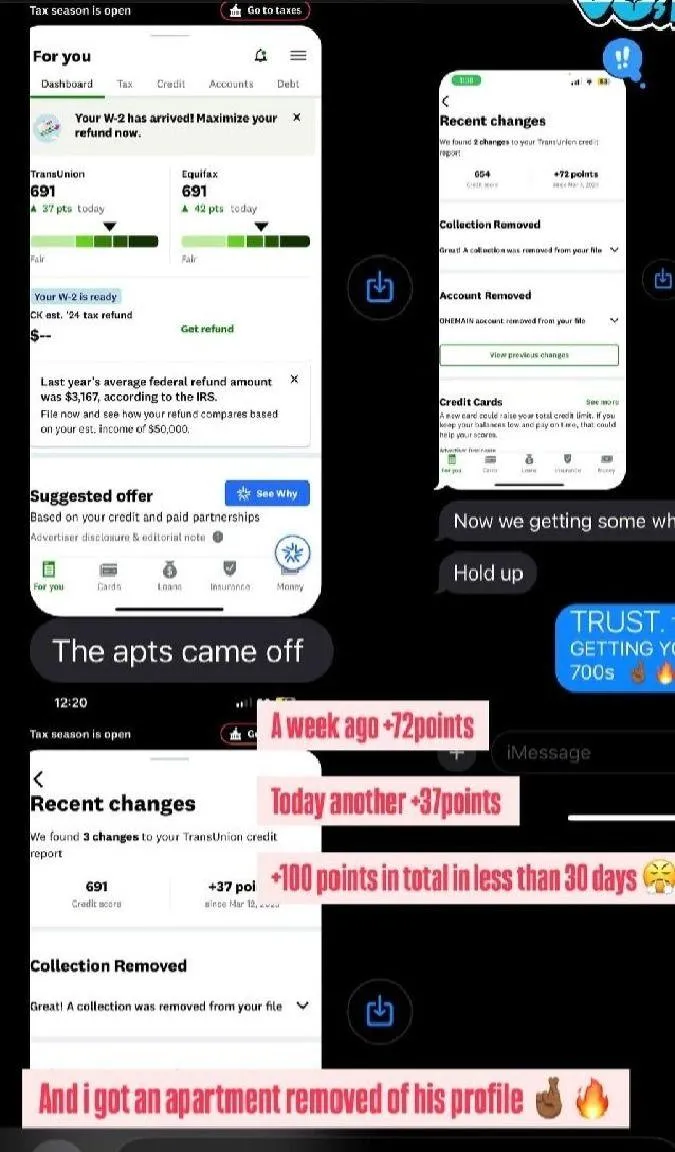

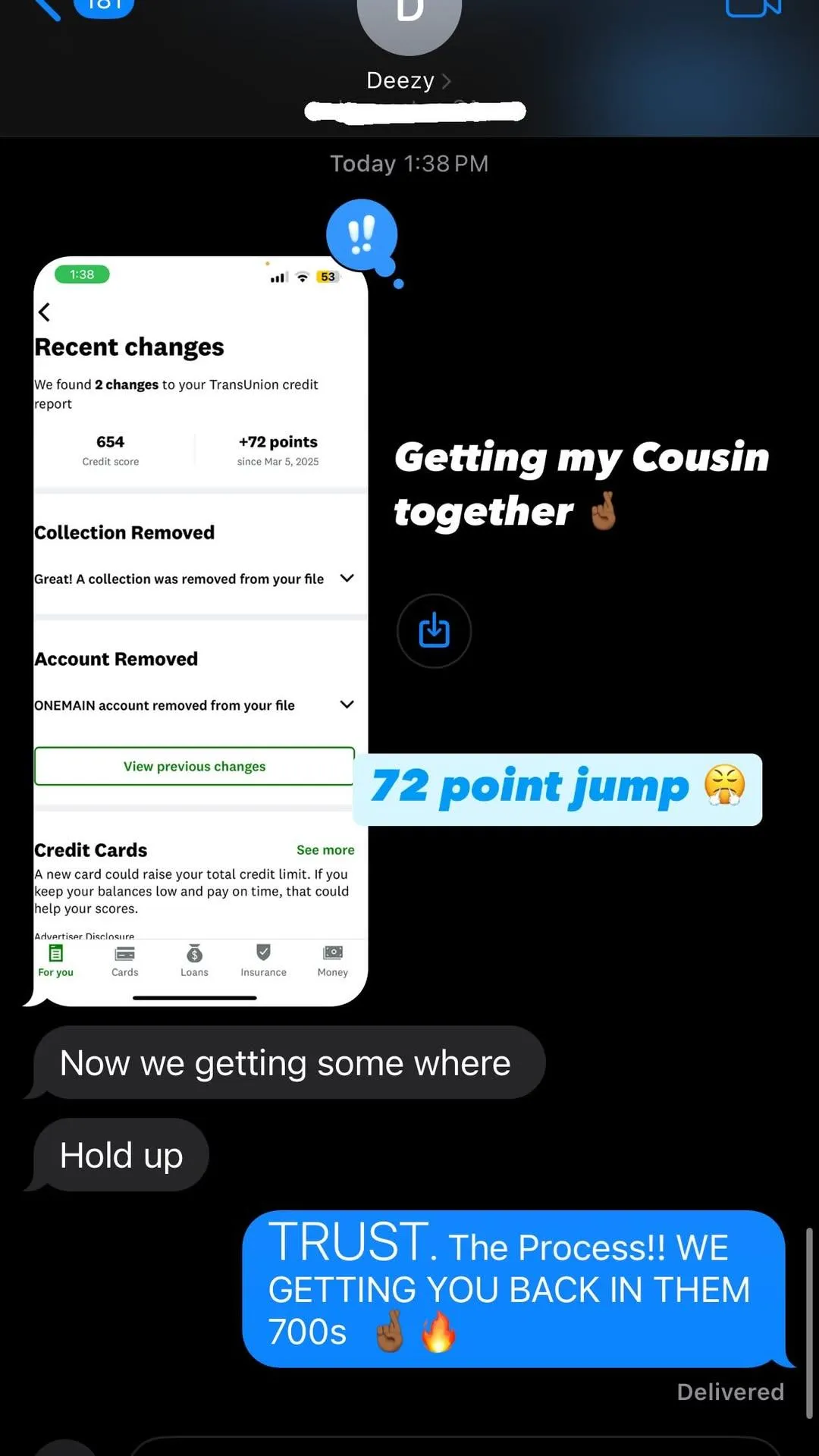

Our Client Reviews

Office: 2232 Dell Range Blvd Ste 245, Cheyenne, Wyoming 82009

Call: 1 888-309-5416

Email:[email protected]